Risk Management in Trading

Risk Management in Trading – Trade Wisely with Free Trading Signal

Trading is an exciting but risky activity. At Free Trading Signal, we believe that proper risk management is essential for long-term success in financial markets. That’s why we provide our signals for free—to help you learn and make informed decisions without unnecessary financial pressure.

Never Trade with Borrowed or Last Funds

One of the key principles of risk management is to only trade with money you can afford to lose. Never use borrowed funds or your last savings for trading. The market is unpredictable, and no strategy guarantees 100% success. Trading should be a calculated decision, not an emotional one driven by financial desperation.

Mistakes and Stop-Losses Are Part of the Process

Even experienced traders make mistakes, and no strategy is flawless. Stop-loss orders exist to protect your capital, and hitting a stop is not a failure—it’s part of a disciplined trading approach. Accepting losses as a normal part of the journey helps you manage risks more effectively and stay in the game long-term.

No Guarantees – Be Cautious and Observe First

We do not guarantee 100% accuracy in our signals, and we do not encourage blind trust in any trading strategy. Before following our signals, observe how they work, analyze the market yourself, and gain confidence in your own decisions. Learning and patience are key components of a successful trader’s mindset.

Why We Work for Free

We offer our signals for free because we believe in transparency and responsible trading. Our goal is to provide valuable insights without adding financial burden to traders. We encourage you to learn, test strategies, and make informed decisions rather than relying on expensive paid services.

Conclusion: Trade Smart, Not BlindlyRisk management is the foundation of successful trading. Never trade with money you cannot afford to lose, accept that losses are part of the process, and take your time to learn before making big moves. Free Trading Signal is here to support your journey—not to make unrealistic promises, but to provide valuable guidance.

Start observing, learning, and trading wisely!

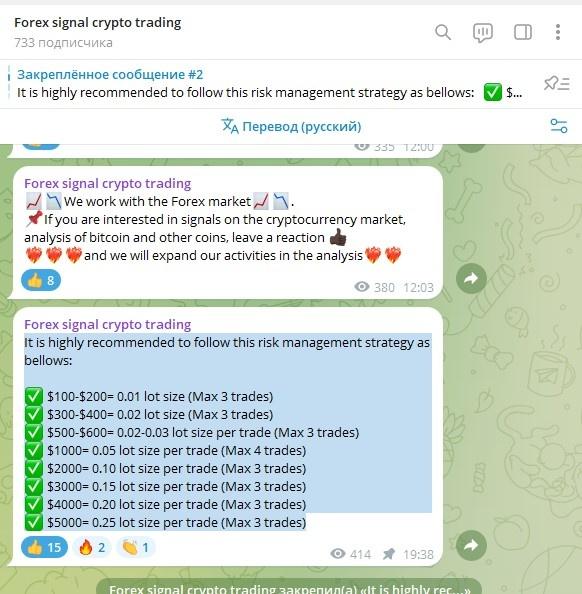

In my channel I recommend using this ratio of trades to your deposit and trade lots

✅ $100-$200= 0.01 lot size (Max 3 trades)

✅ $300-$400= 0.02 lot size (Max 3 trades)

✅ $500-$600= 0.02-0.03 lot size per trade (Max 3 trades)

✅ $1000= 0.05 lot size per trade (Max 4 trades)

✅ $2000= 0.10 lot size per trade (Max 3 trades)

✅ $3000= 0.15 lot size per trade (Max 3 trades)

✅ $4000= 0.20 lot size per trade (Max 3 trades)

✅ $5000= 0.25 lot size per trade (Max 3 trades)

Happy and Safe Trading!